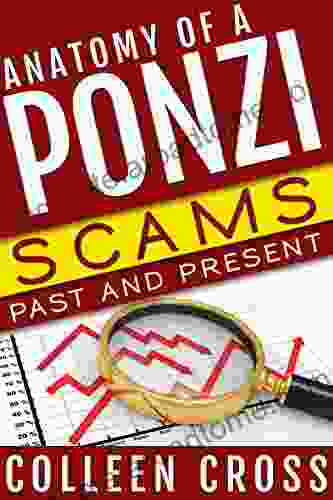

Anatomy of a Ponzi Scheme: Unraveling the Web of Financial Deceit

In the realm of finance, the term "Ponzi scheme" sends shivers down the spines of investors and regulators alike. These fraudulent investment schemes have a long and infamous history, causing billions of dollars in losses and leaving countless victims in their wake.

At their core, Ponzi schemes are based on a simple premise: using new investor funds to pay off earlier investors, creating the illusion of high returns and attracting even more unsuspecting individuals.

4.1 out of 5

| Language | : | English |

| File size | : | 3584 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 297 pages |

| Lending | : | Enabled |

Key Characteristics of Ponzi Schemes

- High Returns: Ponzi schemes typically promise astronomical returns, often far exceeding market averages. These unrealistic returns are designed to lure investors with the promise of easy wealth.

- Lack of Transparency: The inner workings of Ponzi schemes are often shrouded in secrecy. Investors are denied access to financial statements or audited reports, making it difficult to verify the legitimacy of the investment.

- Limited Investment Options: Ponzi schemes often restrict investors to a narrow range of investment options, making it difficult to diversify their portfolios and mitigate risk.

- Aggressive Marketing: Ponzi schemers rely on aggressive marketing tactics, including cold calling, seminars, and social media influencers, to attract new investors.

- Pressure to Reinvest: Investors are often encouraged to reinvest their returns, increasing their exposure to the scheme and prolonging its lifespan.

Case Studies: Lifting the Veil on Ponzi Scams

History is littered with notorious Ponzi schemes that have defrauded millions of people. One of the most infamous cases is the Madoff investment scandal, orchestrated by Bernard Madoff.

Madoff's Ponzi scheme promised steady returns of 10-12% per year, regardless of market conditions. Through a web of shell companies and complex transactions, Madoff paid off early investors with funds from new investors. The scheme collapsed in 2008, resulting in losses estimated at over $64 billion.

Another high-profile Ponzi scheme involved Charles Ponzi himself, after whom the schemes are named. Ponzi's scam in the early 20th century promised high returns on investments in postal reply coupons. By paying early investors with funds from later ones, Ponzi created the illusion of a profitable venture.

Devastating Impact: The Victims of Ponzi Schemes

The consequences of Ponzi schemes extend far beyond financial losses. They erode trust in the financial system, destabilize markets, and leave victims with emotional and psychological scars.

Investors who fall prey to Ponzi schemes often lose their life savings, retirement funds, and other crucial investments. The financial devastation can lead to financial ruin, bankruptcy, and even homelessness.

Beyond financial turmoil, Ponzi schemes can also inflict significant emotional damage. Victims often experience feelings of shame, guilt, and betrayal. They may withdraw from society and struggle to rebuild their lives.

Protecting Yourself from Ponzi Schemes

To protect yourself from falling victim to a Ponzi scheme, it is crucial to be vigilant and aware of the warning signs.

- Be Skeptical of High Returns: If an investment promises unusually high returns, it is essential to exercise caution. Remember, if it sounds too good to be true, it probably is.

- Investigate the Investment: Conduct thorough research on the investment opportunity, its management team, and its financial performance. Check for red flags such as lack of transparency, limited investment options, or a history of complaints.

- Diversify Your Portfolio: Reduce your risk by diversifying your investments across different asset classes and investment vehicles. Avoid concentrating your wealth in a single investment.

- Trust Your Gut: If something about an investment opportunity doesn't feel right, listen to your instincts. Trustworthy investments do not require aggressive marketing or pressure to invest.

- Report Suspicious Activity: If you suspect a Ponzi scheme, report it to the appropriate financial regulatory authorities immediately. Your actions could help protect others from becoming victims.

The Anatomy of a Ponzi Scheme provides a comprehensive understanding of these fraudulent investment schemes, their deceptive tactics, and the devastating impact they can have on individuals and society as a whole.

By arming yourself with knowledge, maintaining vigilance, and reporting suspicious activity, you can protect yourself and others from falling victim to these financial predators. Remember, the best way to avoid a Ponzi scheme is to avoid it altogether.

Join the fight against financial fraud and empower yourself with the knowledge to unravel the web of deceit woven by Ponzi schemers.

4.1 out of 5

| Language | : | English |

| File size | : | 3584 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 297 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Zoe Moore

Zoe Moore Christopher C Horner

Christopher C Horner Cj Dodaro

Cj Dodaro D Arcy O Connor

D Arcy O Connor Simone Mcgrath

Simone Mcgrath Louise Sandhaus

Louise Sandhaus Clifford L Linedecker

Clifford L Linedecker Michael Scammell

Michael Scammell Chris Jevons

Chris Jevons Michelle B Lewin

Michelle B Lewin Craig Woodfield

Craig Woodfield Brandon Gilta

Brandon Gilta Jan Boehm

Jan Boehm Jai Pausch

Jai Pausch D A Carson

D A Carson Jon Power

Jon Power Cynthia Schmidt

Cynthia Schmidt Christopher Glen

Christopher Glen Harriet Shawcross

Harriet Shawcross Winter Morgan

Winter Morgan

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gustavo CoxA Gastronomic Journey Through the South of France: Unraveling the Secrets of...

Gustavo CoxA Gastronomic Journey Through the South of France: Unraveling the Secrets of... Evan SimmonsFollow ·18.4k

Evan SimmonsFollow ·18.4k Wade CoxFollow ·15.7k

Wade CoxFollow ·15.7k Jesus MitchellFollow ·6k

Jesus MitchellFollow ·6k Foster HayesFollow ·10.5k

Foster HayesFollow ·10.5k Shannon SimmonsFollow ·12.8k

Shannon SimmonsFollow ·12.8k F. Scott FitzgeraldFollow ·10k

F. Scott FitzgeraldFollow ·10k Aron CoxFollow ·16.3k

Aron CoxFollow ·16.3k Arthur Conan DoyleFollow ·12k

Arthur Conan DoyleFollow ·12k

Charles Bukowski

Charles BukowskiUnlock Your Entrepreneurial Potential: Start Small,...

Are you ready to embark on an exciting journey...

Braeden Hayes

Braeden HayesUnveiling the Extraordinary Tale of "Weird Girl With...

A Journey of...

Shawn Reed

Shawn ReedLearning To Love Ourselves As We Are: A Journey Towards...

In the tapestry of life, self-love emerges...

Allan James

Allan JamesQuick Guide to Pipeline Engineering: Your Gateway to...

Welcome to the realm of...

Beau Carter

Beau CarterLife With and After an Addict: A Journey of Understanding...

Addiction is a complex and devastating...

4.1 out of 5

| Language | : | English |

| File size | : | 3584 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 297 pages |

| Lending | : | Enabled |